Novo Car Insurance Debuts in Arizona With Pricing That Lets Drivers Influence What They Pay

Fair, transparent pricing drivers can control with the Novo Safety Score—updates monthly, not every six months, with in-app tips to help lower bills

We show drivers exactly how their car's driving patterns affect pricing and provide coaching to improve. With monthly rate updates, safer driving translates to savings faster.”

SANTA CLARA, CA, UNITED STATES, November 5, 2025 /EINPresswire.com/ -- Novo Insurance announced its launch in Arizona, introducing month-to-month pricing tied to driving behavior. Novo puts drivers in control by linking premiums to a transparent "Safety Score" based on how each vehicle is driven, so safer driving can influence what drivers pay sooner—rather than six months later.— Sal Dhanani, Co-Founder and President at Novo Insurance

"Insurance shouldn't be a mystery," said Sal Dhanani, Co-Founder & President at Novo Insurance. "We show drivers exactly how their car's driving patterns affect pricing and provide coaching to improve. With monthly rate updates instead of six-month cycles, safer driving translates to savings faster."

Drivers can get started in two ways:

1. Instant Quote: Get an upfront safe-driver program enrollment discount.

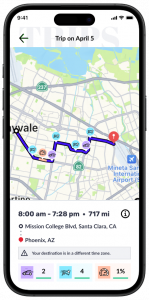

2. Drive then quote: Use the Novo app to earn a personalized discount based on how a car is driven. This could be potentially higher than the standard enrollment discount if a car is driven safely. Each car's Safety Score is revealed after customers complete five trips and drive 200 miles (or five trips and 50 miles after two weeks, whichever comes first).

Novo offers three plans to fit different needs:

• Flex: For the fastest path to savings, this plan includes 25% savings for enrolling in the first two months. Starting in month three, the monthly price adjusts directly based on each car's Safety Score. Monthly pricing means rates can increase or decrease based on driving behavior, giving drivers more frequent opportunities to lower their bill through safer habits.

• Next: This plan offers a fixed price for six months with 20% savings for enrolling. The renewal rate is tied to the Safety Score.

• Classic: For drivers who prefer traditional six-month pricing, this plan offers a 10% discount for sharing driving data through the app. Each car receives its own Safety Score and personalized driving insights, but the score won't affect the rate—it's for educational purposes only. If a driver consistently scores well, they may want to consider upgrading to Next or Flex plans, where safer driving unlocks additional savings.

How the Novo Safety Score works:

The Novo Safety Score reflects how smoothly and safely each car is driven, based on three key habits drivers can control: hard braking, speeding, and rapid acceleration. The app provides detailed feedback and actionable insights on how to improve.

All drivers listed on the policy are required to install the Novo app. The app uses Bluetooth to automatically detect which car is being driven, so each vehicle's Safety Score accurately reflects how it's driven by the household's drivers. Occasional trips by unlisted drivers—like a neighbor borrowing the car—won't affect the score.

Get a quote • iOS • Android (https://play.google.com/store/apps/details?id=com.novo.insurance.client&pli=1)

About Novo Insurance

Novo's mission is to create a preventive, affordable and seamless auto insurance experience. By providing drivers with a Safety Score and in-app coaching, Novo aims to encourage safer driving habits. The company leverages AI-driven automation to reduce operational costs and deliver competitive pricing. Novo's direct-to-consumer platform and network of trusted independent agencies offer a fast quote process, an intuitive app and accessible support.

Noah Dye

Spoken Voice PR

+1 559-430-5799

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.